kern county property tax assessor

Get Information on Supplemental Assessments. Property searches are allowed only by parcel identification numbers APN and ATN and address not by owner name.

Kern County Treasurer And Tax Collector

Please type the text from the image.

. Change a Mailing Address. File an Exemption or Exclusion. No Fee is Necessary to Request a Value Review or to File an.

Change a Mailing Address. File an Assessment Appeal. If you are having trouble viewingcompleting the forms you will need to download.

Press enter or click to play code. The kern county assessors office located in bakersfield california determines the value of all taxable property in kern county ca. Kern County Property Records are real estate documents that contain information related to real property in Kern County California.

Find Property Assessment Data Maps. Search Any Address 2. KERN COUNTY ASSESSOR CHANGE OF ADDRESS FORM Please Type or Print Property valuation information and tax bills are mailed to the address contained in Assessors Office records.

The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Proposition 13 - Article 13A Section 2 enacted in 1978 forms the basis for the current property tax laws. See Results in Minutes.

Handled by the Assessors Office Application to Reapply Erroneous Tax Payment. Tax amounts are determined by the tax rates and values. The majority of Assessor forms are developed and provided by the California State Board of Equalization.

Look Up Any Address in Kern County for a Records Report. Should you require additional information on how the taxes were calculated contacted the Office of the Auditor-Controller-County Clerk at 661 868-3599. Enter an 8 or 9 digit APN number with or without the dashes.

The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. Our mission is to collect manage and safeguard public funds to provide community services to the constituents of Kern County and we strive to do this in the most efficient and effective manner possible. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

Request For Escape Assessment Installment Plan. It is important that we have your current mailing address to avoid unnecessary delays in delivery. File an Assessment Appeal.

The Kern County Assessors Office located in Bakersfield California determines the value of all taxable property in Kern County CA. Please select your browser below to view instructions. Search for Recorded Documents or Maps.

Taxes are levied on property as. See detailed property tax information from the sample report for 10804 Thunder Falls Ave Kern County CA. The Kern County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Kern County and may establish the amount of tax due on that property based on the fair market value appraisal.

Get In-Depth Property Reports Info You May Not Find On Other Sites. It is the owners responsibility to advise the Assessor when the. Kern County Assessors Office Services.

How to Use the Property Search. Find Property Assessment Data Maps. Purchase a Birth Death or Marriage Certificate.

See Property Records Deeds Owner Info Much More. Search results will not include owner name. Application for Tax Relief for Military Personnel.

Search for Recorded Documents or Maps. Check for Foreclosure Notices and Tax Liens. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a.

Use our online tool to check for foreclosure notices and tax liens on a property. Get Information on Supplemental Assessments. Application for Tax Penalty Relief.

To our web site. Request a Value Review. Kern county has one of the highest median property taxes in the united states and is ranked 606th of.

Kern County collects on average 08 of a propertys assessed fair market value as property tax. Cookies need to be enabled to alert you of status changes on this website. In addition to the forms listed below more forms related to Changes in Ownership Exemptions Exclusions Business Personal Property and Tax Savings Programs are made available through a partnership with the California Assessors Association at Cal.

The total assessed value of all taxable property in the county as of january 1 2020 is valued 1022 billion a 28 billion increase over the prior year said the assessors office. Request a Value Review. The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including at least 40 percent equity in the home and an annual household income of 45000 or less among other requirements.

Purchase a Birth Death or Marriage Certificate. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County. Kern County has one of the highest median property taxes in the United States and is ranked 606th of the 3143 counties in order of median property taxes.

Establecer un Plan de Pagos. Learn about the 10 Recorder Anti-Fraud Fee attached to the recording of several real estate instruments. Enter a 10 or 11 digit ATN number with or without the dashes.

Ad Download Property Records from the Kern County Assessors Records. Kern county collects on average 08 of a propertys assessed fair market value as property tax. File an Exemption or Exclusion.

It is an honor and a privilege to have the opportunity to serve the taxpayers of Kern County. Please enable cookies for this site.

Kern County Treasurer And Tax Collector

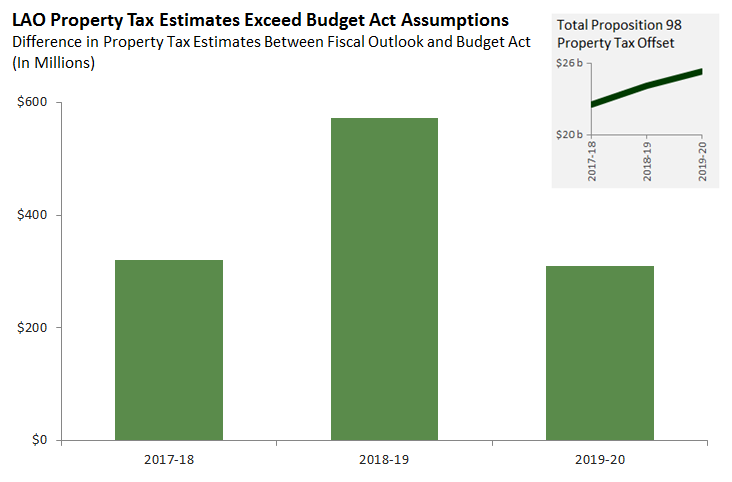

Fiscal Outlook Property Tax Estimates Exceed Budget Expectations Econtax Blog

Kern County Treasurer And Tax Collector

Kern County Ca Property Tax Search And Records Propertyshark

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Kentucky Fannie Mae Homepath Renovation Loans Credit Score Requirements Fannie Mae Renovation Loans Home Renovation Loan

Orange County Ca Property Tax Search And Records Propertyshark

California Public Records Public Records California Public

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

San Joaquin County Ca Property Tax Search And Records Propertyshark

Kern County Ca Property Tax Search And Records Propertyshark

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Kern County Ca Property Tax Search And Records Propertyshark